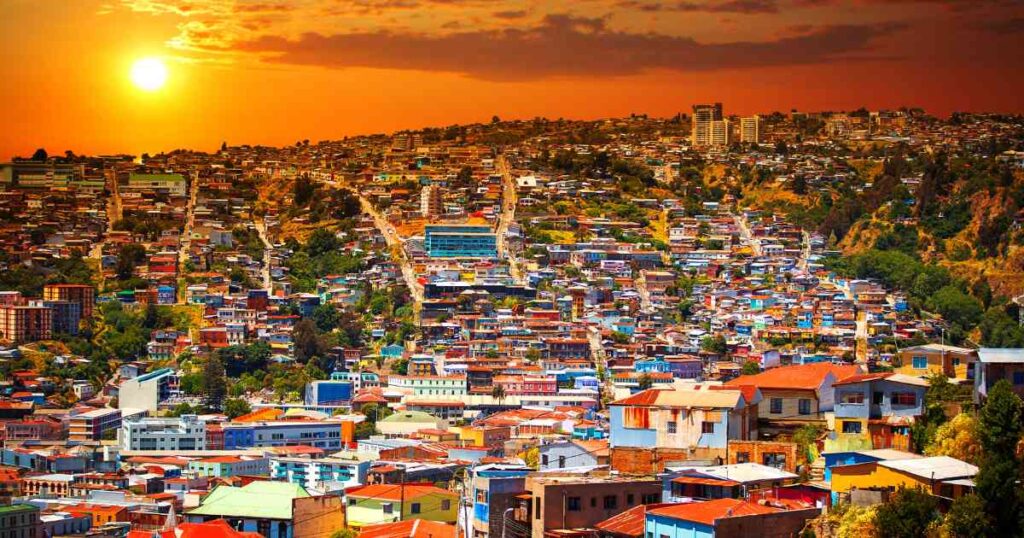

Payment Solutions in Chile

Chile’s payment landscape is dynamic and diverse, encompassing traditional, e-commerce, and alternative payment methods. Traditional payments like credit and debit cards dominate, with cards being used for approximately 60% of transactions. The e-commerce sector is rapidly growing, driven by a high internet penetration rate and a robust digital infrastructure, leading to a 35% annual increase in online sales. Alternative payments are gaining traction, with mobile wallets and digital payment platforms such as MercadoPago and Webpay becoming increasingly popular, especially among younger consumers. Bank transfers also play a significant role, accounting for around 25% of online transactions. This varied payment ecosystem reflects Chile’s adaptability and technological advancement in financial services.

19.9 million

16 million

CLP

$8.29 billion

$301 billion

$17,083.00

UBank Connect offers a comprehensive suite of payment solutions in Chile, designed to meet the diverse needs of businesses and consumers. The available payment methods include cash, bank transfers, and QR code payments, ensuring a versatile and accessible payment infrastructure. Cash payments remain essential for a significant portion of the population, while bank transfers provide a secure and reliable method for both personal and business transactions. QR code payments, a rapidly growing trend, offer a convenient and contactless option, enhancing the customer experience in both online and offline environments. With UBank Connect’s robust payment solutions, businesses in Chile can cater to a wide range of customer preferences, driving growth and customer satisfaction.

Discover how UBank Connect can enhance your payment solutions in Chile. Contact us today to learn more about how we can support your business. Let’s connect and take your payment processes to the next level.

Dubai

Business Center 1, M Floor, The Meydan Hotel. Nad Al Sheba, Dubai, U.A.E.

Copyright © 2024 UBank Connect. All Rights Reserved.