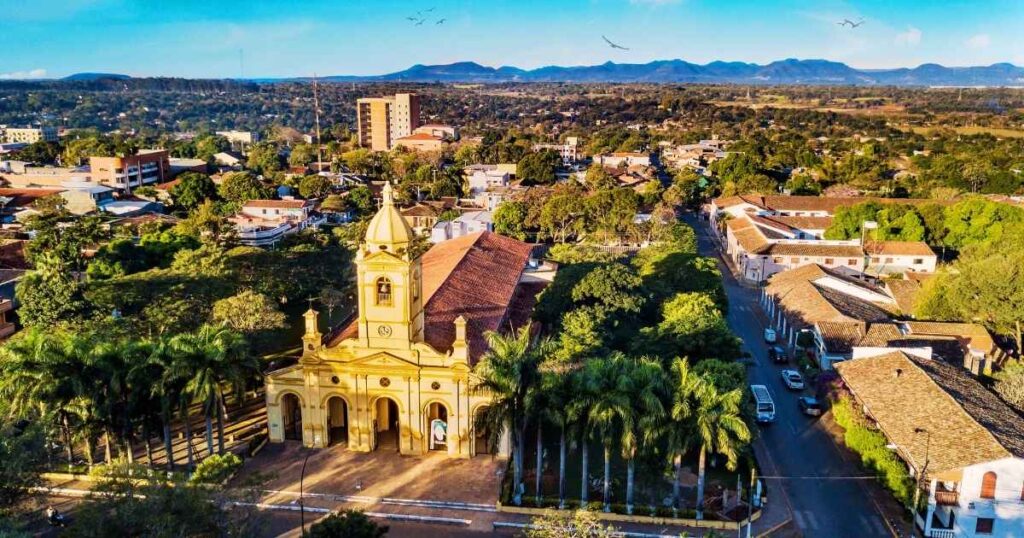

Payment Solutions in Paraguay

Paraguay’s payment landscape is evolving with a mix of traditional, digital, and alternative methods, especially in urban areas like Asunción. While cash remains important for daily transactions, particularly in small businesses and informal markets, digital payments are becoming increasingly popular. Debit and credit cards are widely accepted, and mobile banking is gaining traction, with many banks offering real-time transfers at no extra fee. Digital wallets, such as Mercado Pago, are also widely used, especially in e-commerce. QR code payments, powered by local banks’ mobile apps, are on the rise, offering a secure and contactless alternative. Paraguay’s e-commerce sector has seen significant growth, with payments through digital wallets and account-based transfers becoming dominant. Recent data suggests Paraguay is adapting well to global payment trends, positioning itself as an active player in Latin America’s rapidly expanding digital commerce scene.

6.9 million

5.62 million

PYG

$1.34 billion

$171.22 billion

$5,869.33

UBank Connect offers streamlined payment solutions for businesses in Paraguay, focusing on secure and efficient bank transfers. By integrating UBank Connect’s payment system, businesses can easily manage local transactions without worrying about additional fees often associated with card payments or digital wallets. The service is designed to ensure quick, real-time transfers, promoting smooth operations for businesses of all sizes. Whether for e-commerce transactions or B2B payments, UBank Connect simplifies the process while providing a reliable, cost-effective alternative to traditional payment methods. To improve your business’s payment efficiency in Paraguay, start using UBank Connect today and experience seamless transactions at your fingertips.

Discover how UBank Connect can enhance your payment solutions in Paraguay. Contact us today to learn more about how we can support your business. Let’s connect and take your payment processes to the next level.

Dubai

Business Center 1, M Floor, The Meydan Hotel. Nad Al Sheba, Dubai, U.A.E.

Copyright © 2024 UBank Connect. All Rights Reserved.