Payment service providers play a significant role in the payment ecosystem. They enable businesses to accept online payments, including credit cards, debit cards, cash cards, and e-wallets securely anywhere in the world, like UBank Connect.

What is a PSP?

Payment service providers, often known as merchant service providers or PSPs, are third-party service providers who assist merchants in accepting payments. Simply put, payment service providers connect merchants to the broader financial infrastructure, allowing them to take credit and debit card payments (as well as Direct Debit, bank transfer, real-time bank transfer, and so on). They offer a merchant account as well as a payment gateway, allowing businesses to receive and manage payments in a straightforward and efficient manner.

Advantages of PSPs

- PSPs, in contrast to most merchant service account providers, generally offer services like as invoicing, reporting, team management, loyalty programs, tailored marketing, and a synchronized web store.

- PSPs are typically less expensive to setup and maintain than merchant accounts.

- Payment service providers often provide a quick setup process to get you up and running as soon as possible.

- Many payment service providers have strong security criteria for PSP payments. Businesses may ensure the security of their customers’ financial data by remaining PCI DSS compliant.

- The ability to generate transaction reports makes it easier to reconcile transactions and keep your accounts in order. In most cases, this will be monthly reports, while some providers offer real-time information.

- Many PSPs make cross-border payments possible by accepting multiple currencies. This is an essential service for any company wanting to establish itself in the worldwide market. They also keep up with new payment options, making them available to you when they emerge.

Potential drawbacks of PSPs

- The disadvantage of quick approval and setup is that your account is more likely to be frozen or terminated if your business is suddenly deemed to be too risky. This might mean weeks of downtime before you’re back up and running. The additional verification procedure required by merchant account providers may be stressful, but it helps assure that your account will stay operational in the long run.

- Transaction size and processing volume are typically limited by PSPs. This could become a concern when your company grows.

What are the benefits of using a payment service provider?

There are a lot of advantages to PSPs and PSP payments. Most significantly, they handle the entire payment process, allowing you to focus on your main company without worrying about whether you’ll be paid. Furthermore, PSP payments can be made using a variety of methods. Accepting as many payment methods as possible allows you to avoid turning away potential consumers and thus increase your sales.

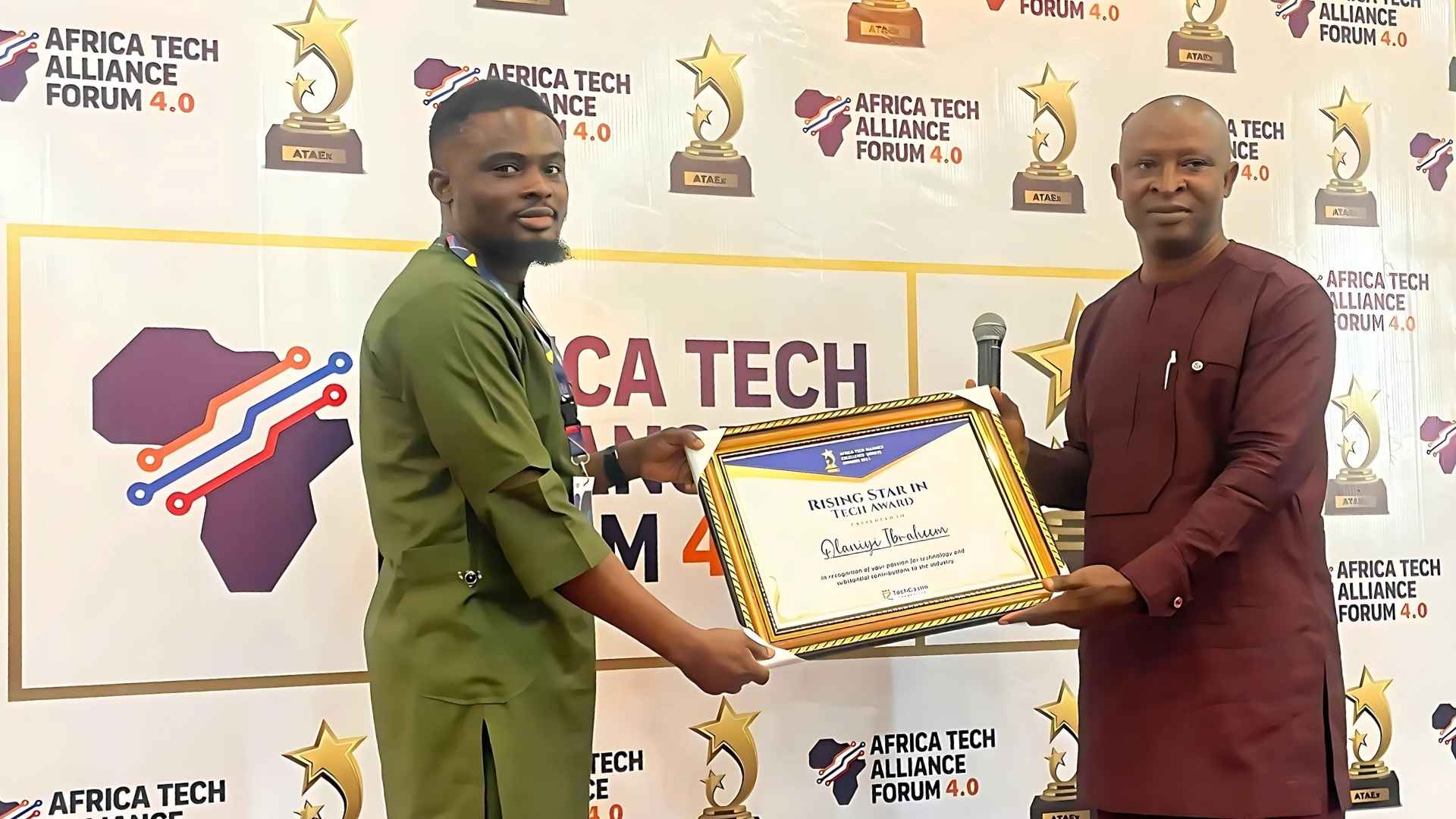

UBank Connect helps you in automating transactions with a simple setup and integration and easy-to-use dashboard. Get paid on time without having to lift a finger. Discover how UBank Connect can improve your business’ payment processing today.