Payment Solutions in Uganda

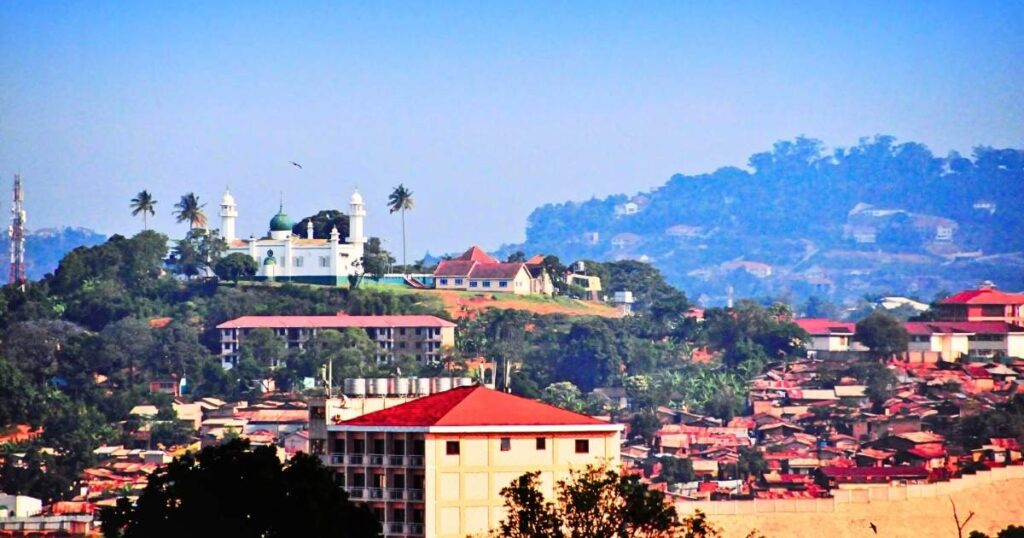

Uganda is quickly becoming a leader in mobile money adoption, with millions of users relying on Airtel Money and MTN Mobile Money for everyday transactions. With over 56 million active mobile money accounts nationwide, these platforms have transformed the way people send and receive money, making cashless payments the norm. In fact, mobile money transactions in Uganda exceed $10 billion annually, reflecting a booming digital economy that businesses can no longer afford to ignore.

For companies looking to expand in Uganda, integrating Airtel and MTN mobile money payment methods is essential to meet customer preferences and tap into this growing market. These mobile wallets offer fast, secure, and convenient ways to pay, helping businesses streamline operations and improve customer satisfaction. As digital payments become more popular, having access to reliable and seamless mobile money options is a key driver of success in Uganda’s dynamic financial landscape.

51.3 million

14.2 million

UGX

$123.87 million

$64.28 billion

$1,338.50

UBank Connect provides businesses with a robust and secure payment gateway tailored to Uganda’s mobile money landscape. By enabling seamless integration of Airtel Money and MTN Mobile Money, UBank Connect helps companies accept payments quickly and efficiently, no matter their size or location. This solution simplifies transaction management, reduces processing times, and ensures the highest level of security for both merchants and customers.

Ready to expand your business in Uganda and capture the benefits of mobile money payments? Discover how UBank Connect can empower your payment processes and help you stay ahead in this fast-evolving market.

Discover how UBank Connect can enhance your payment solutions in Uganda. Contact us today to learn more about how we can support your business. Let’s connect and take your payment processes to the next level.

Dubai

Business Center 1, M Floor, The Meydan Hotel. Nad Al Sheba, Dubai, U.A.E.

Copyright © 2024 UBank Connect. All Rights Reserved.