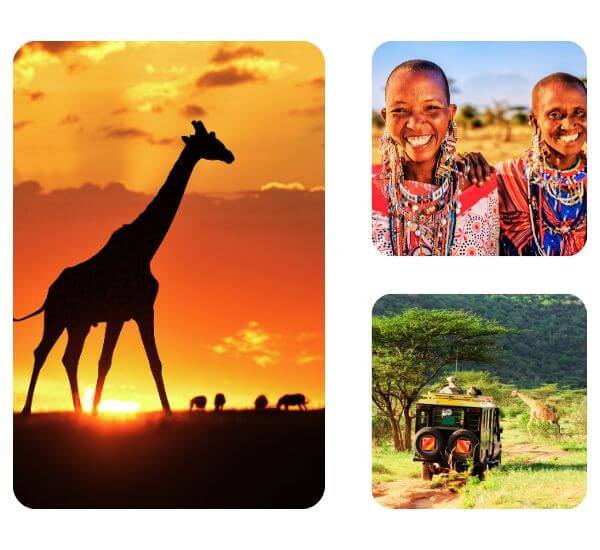

e-Commerce and Payments in Kenya

A vibrant country where alternative payment methods dominate.

Kenya has seen a tremendous transition, with mobile payments leading the way. The phrase "payment Kenya" is frequently used to describe the manner in which Kenyans do transactions, though grammatically unconventional.

Market Overview

-

Population

55.1 million

-

Online Population

17.9 million

-

Currency

KES

-

e-Commerce Market Value

$2.8 billion

-

GDP

$119.6 billion

-

GDP per Capita

$2,269

Card-based Payments

0%

Cash-based Payments

0%

Bank Transfer

0%

Wallets

0%

Smartphone Penetration

0%

Internet Penetration

0%

Available Local Payment Method

M-Pesa

Type

e-Wallet

Regions

Africa

Key Takeaways

- 53.7% of the average consumer spending in Kenya is in the category of food and non-alcoholic drinks. Toys and hobbies, furniture and appliances, food and personal care, electronics, and media, as well as fashion, accounted for the majority of e-commerce revenues.

- Jumia.co.ke received 4.49 million hits in July 2022, making it the most visited e-commerce site in Kenya.

- Over 1.2 billion mobile money transactions totaled more than $23 billion in July 2022, just that one month’s worth of transactions.

- The opening of digital-only banks is predicted to enhance financial inclusion in Kenya, which will further push the adoption of debit card transactions. The Kenya cards and payments market volume was $49.5 million in 2022 and is expected to reach a CAGR of more than 17% between 2022-2026.